When it comes down to it, sports betting is all about math. At least if you want to be successful. Many veteran punters tout the benefits of “knowing the game” – and there’s a lot to be said about experience. However, top bookmakers themselves don’t rely on some hidden trove of knowledge of how each player will perform against another to set their prices. They use statistics. And if you want to beat the bookies, you’ll have to think like the bookies. Thankfully, people have been mulling over this for decades, and the Kelly criterion is one of the results.

What Is the Kelly Criterion?

The Kelly criterion is a mathematical formula that determines the optimal size of a bet. It relies on the principles of probability theory to maximize the expected value. Essentially, the Kelly bet tells you how much of your bankroll you should put up as a stake to get the best results.

The full scope and math behind the criterion may be a bit too much if you just want to take a few punts. And that’s fine. This Kelly criterion football betting guide will focus on the practical application of Dr. Kelly’s theory. That said, we recommend that you have a firm grasp of the notion of betting value before we begin.

If you’re not convinced about the validity of this strategy, here’s an interesting bit of info. Although the Kelly strategy was initially developed for betting, the same ideas were used to explain diversification in financial investments. Nowadays, the Kelly bet is a big part of mainstream investment theory. If this strategy is good enough for Warren Buffet, it’s good for us too.

Another thing worth noting is that, much like betting value calculations, the formula requires a bit of guesswork. Specifically, you’ll need to know the approximate probability of a certain outcome in a football match. You can never be 100% sure about such things in sports, though. That’s why even the Kelly betting strategy is not foolproof.

The Kelly Bet Formula

Let’s start with the formula itself before we dive into using it. The original formula goes like this:

f = p – q/b

Where:

- F is the percentage of your total bankroll you should wager.

- P is the probability of winning.

- Q is the probability of losing (in other words, 1 – P.)

- B is the multiple of your stake you’re expected to win. The easiest way to explain is this – decimal odds minus 1.

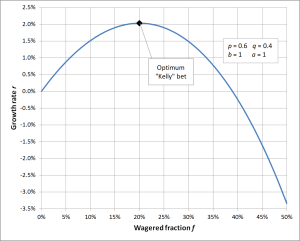

Perhaps the best way to explain is through a Kelly criterion betting example. Let’s say you believe that the given bet has a 60% shot at winning, and you’re wagering at odds of 2.00.

f = 0.6 – 0.4/1 = 0.2

This formula implies you should use 20% of your total bankroll to maximize value.

Now you might be thinking – but if the bet itself has a positive value, shouldn’t I just wager as much as possible?

You need to understand that positive value bets can still lose. There is still a risk involved, and wagering everything you have still has a 40% chance of costing you the entire bankroll. If you stick to the formula, you can always be sure that the risk you’re taking is worth the potential reward. By that logic, riskier bets will use a smaller chunk of the bankroll, even if they have positive value.

Kelly Strategy Limitations and Advantages

The more perceptive of our readers probably noticed a few problems here. First of all, the Kelly criterion only works with positive value bets. If you try to use the formula for a negative value wager, you’ll come up with a zero. That’s the formula telling you not to take that bet.

Finding bets with value is the hardest part of a successful betting career, however. And this math formula can’t help you with that, sadly. However, the Kelly criterion strategy explains just what to do with such opportunities when you find them. Don’t gloss over just how important that knowledge can be. After all, if positive value bets in football are so rare, it makes sense to optimise how you use them.

Another issue is that you have to be sure that the probabilities you’re working with are accurate. Absolute certainty is not a thing in sports betting, of course. However, bookies have been making millions on the back of being right more often than they’re wrong. That’s what you should strive for as well.

If you understand how to use the Kelly criterion in football betting, it’s hands-down the best money management method. It’s a simple way to perfectly take advantage of good betting opportunities, which leads to earnings in the long run.

However, don’t expect it to be some sort of magic spell that makes you win football bets you otherwise wouldn’t. The Kelly bet strategy is all about maximizing the profits of opportunities you already have.

- Soccer News Like

- Be the first of your friends!